Business

Features

News

Building construction prices rise across all sectors in Q3 2020

November 12, 2020 | By Anthony Capkun

Building construction prices Q3 2020

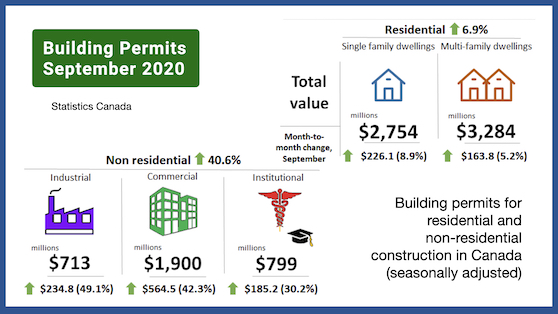

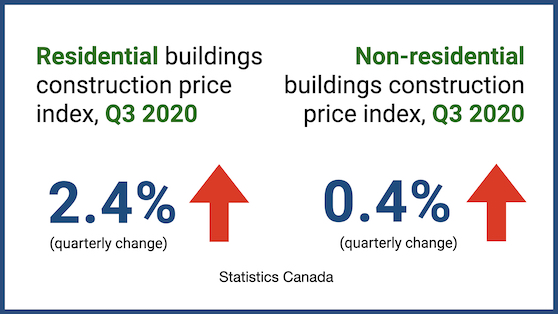

Building construction prices Q3 2020 November 12, 2020 – Prices for residential building construction rose 2.4% in the third quarter, the largest gain since the index was introduced in the first quarter of 2017, while the cost of non-residential building construction increased 0.4%.

All census metropolitan areas (CMAs) covered in Statscan’s latest survey reported higher residential building construction prices. Non-residential building construction prices in Calgary, Edmonton and Vancouver were flat, while the remaining CMAs reported price increases.

Supply chains for lumber continued to be strained, as both supply and demand pressures drove lumber and other wood product prices up in the third quarter. Contractors also reported increased retail demand for lumber, with retailers selling directly to homeowners for DIY projects.

Increased demand was felt more strongly in the residential construction sector. According to the Building Permits Survey, the total value of residential building permits rose 6.9% in September. Residential building construction investment increased 8.2% in August and exceeded pre-Covid-19 levels (February 2020).

SEE ALSO September 2020 building permits show growth across all sectors.

Demand for building materials also increased in the third quarter. According to the Sawmills survey, even though total softwood and hardwood production was up on a year-over-year basis in June (+0.7%) and July (+1.5%), these increases did not offset the steep year-over-year declines observed in April (-33.5%) and May (-18.7%) due to mill shutdowns.

Although total softwood and hardwood production increased in June and July, shipments for those same products were down in June (-6.2%) and July (-0.7%) from the previous year. This may be attributable to truck driver shortages and decreased rail car availability.

Additionally, a strike at the Port of Montreal led to disruptions in regular port operations in August, which later trickled to other Canadian ports, creating further rail car imbalance across the country. Pressure-treated lumber and oriented strand board were cited as the types of lumber products with the lowest available supply. The shortages for these products could continue well into the fourth quarter.

General contractors in the non-residential sector across Canada continued to face higher lumber prices and insurance rates and lower productivity due to Covid-19 physical distancing and hygiene requirements. As market uncertainty continues, general contractors reporting data for the Construction Contractors Survey indicated that they are bidding on fewer projects, reducing margins and constraining price increases.

As the seasonality of the construction industry slows demand in Q4, suppliers may have the opportunity to catch up on production and complete outstanding orders. This may help some contractors catch up on existing projects currently constrained under the new work conditions, as well as by ongoing labour and material shortages.

SEE ALSO Shutdowns, blockades, pine beetles, trucker shortages… oh yeah, and Covid!

CCA Webinar October 2020: Top left, clockwise: Ed Whalen, Bart Kanters, Derek Nighbor, Mary Van Buren

Nationally, construction costs rose for every residential building type included in the survey in Q3, with increases ranging from 0.9% to 2.9%. The largest quarterly price increase was for townhouses (+2.9%), followed by single-detached houses (+2.8%).

Residential construction costs rose the most in Moncton (+3.3%), Edmonton and Calgary (both up 3.0%). Increased demand and low inventory for residential units, combined with higher lumber prices, drove construction costs up in Moncton. In Edmonton and Calgary, residential building construction prices were pushed upwards by higher lumber and insurance costs.

Non-residential building construction costs rose 0.4% in the third quarter, following a 0.1% increase in the second quarter.

Against a competitive market backdrop with greater market uncertainty and fewer project tenders available, non-residential building costs remained flat in Vancouver, Edmonton and Calgary. General contractors in these cities have been absorbing increased material costs, resulting in lower profit margins.

Montreal (+1.2%) and Ottawa (+0.9%) reported the largest increases in non-residential building construction costs, citing increased overhead costs due to Covid-19, scheduled union wage increases and rising raw material costs.

Residential building construction costs rose 4.0% year-over-year in the third quarter, following a 2.1% increase in the second quarter.

Construction costs for residential buildings rose the most in Moncton (+5.3%), Ottawa (+5.0%) and Montreal (+4.6%) on a year-over-year basis.

Non-residential building costs (+1.4%) continued to rise during the 12-month period ending in the third quarter. The costs of factory buildings in Montreal and school buildings in both Montreal and Ottawa contributed the most to the increase in non-residential building construction costs.

Year-over-year, non-residential building construction costs rose the most in Montreal (+3.4%) and Ottawa (+2.9%) in the third quarter.

Print this page