December 11, 2015 – DuPont and The Dow Chemical Company announced their boards of directors unanimously approved a definitive multi-billion-dollar agreement under which the companies will combine in an all-stock “merger of equals”. The combined company will be named DowDuPont.

“This transaction […] reflects the culmination of a vision we have had for more than a decade to bring together these two powerful innovation and material science leaders,” said Andrew N. Liveris, Dow’s chair and CEO.

PHOTO: Edward D. Breen, chair and CEO of DuPont, and Andrew N. Liveris, president, chair and CEO of Dow.

“This merger of equals will create significant near-term value through substantial cost synergies and additional upside from growth synergies,” said Edward D. Breen, chair and CEO of DuPont.

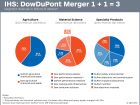

The parties intend to pursue a separation of DowDuPont into three independent, publicly traded companies through tax-free spin-offs, expected to occur 18-24 months following the closing of the merger, subject to regulatory and board approval. Besides agriculture, the other two business would be a Material Science company and a Specialty Products company.

The Material Science Company would consist of DuPont’s Performance Materials segment as well as Dow’s Performance Plastics, Performance Materials and Chemicals, Infrastructure Solutions, and Consumer Solutions (excluding the Dow Electronic Materials business) operating segments.

The Specialty Products Company would be focused on businesses that “share similar investment characteristics and specialty market focus,” including DuPont’s Safety & Protection and Electronics & Communications, as well as the Dow Electronic Materials business.

Upon closing of the transaction, the combined company would have a combined market capitalization of about $130 billion at announcement. The deal is expected to deliver about $3 billion in cost synergies, with 100% of the run-rate cost synergies achieved within the first 24 months following the closing of the transaction. Additional upside of about $1 billion is expected from growth synergies.

Print this page