Business

Features

News

Electrical product prices still high – Building construction price indexes, Q1 2022

June 10, 2022 | By Anthony Capkun

June 10, 2022 – Statscan reports electrical product prices continued to climb in the first quarter of 2022, with electrical safety and security systems recording historically strong quarterly price growth. These higher prices have had a particular impact on the construction costs of schools and factories.

Prices for electrical, electronic, audio-visual and telecom products also reached a year-over-year peak (+20.9%) in February 2022, which continued the upward trend observed in the previous year.

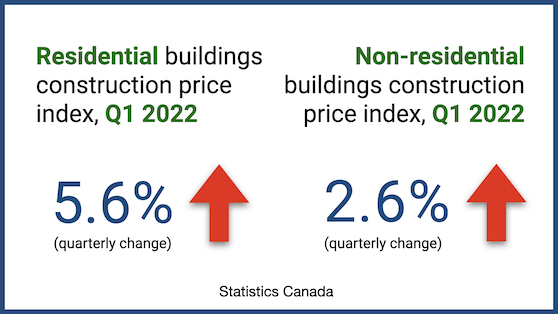

Residential building construction costs increased 5.6% overall nationally in the first quarter of 2022, the highest increase since the second quarter of 2021. Non-residential building construction costs were up 2.6% in Q1 2022.

The contractors surveyed attributed part of the growth in building construction costs to the rise in labour costs, and a surge in the number of vacancies for construction trades has contributed to increased wages in these occupations.

In addition, amid rising fuel prices, contractors cited that a larger share of their expenses were now allocated to the transportation of their building materials.

Increases in non-residential building construction costs continued to slow or stabilize in most of the Census Metropolitan Areas (CMAs)* covered by the survey. Rising non-residential construction costs remained largely driven by continued price growth in structural metal products, which have been impacted by supply chain constraints.

Non-residential building construction costs rose the most in Toronto (+3.6%) and Montreal (+3.0%), with the cost to construct warehouses and factories increasing the most in these CMAs. Higher construction costs in Toronto may have been influenced by demand conditions, with increased investment in warehouses and factories. Specifically, investment into warehouses in Toronto reached an all-time high in January, while investment into factories rebounded between November 2021 and February 2022 after declining over the previous year and a half.

St. John’s (+1.0%) experienced the smallest quarterly price increase, followed closely by Moncton (+1.2%). St. John’s recorded its smallest increase since the fourth quarter of 2020.

On the residential side, growth in building construction costs accelerated during Q1 2022, after moderating in the previous two quarters. The majority of the 11 CMAs covered by Statscan’s survey recorded larger quarterly increases than the previous two quarters. Rising residential construction costs were largely driven by rebounding softwood lumber prices.

Costs to construct residential buildings increased the most in Calgary (+6.9%), followed by Edmonton and Toronto (both up 6.8%). While the construction costs to build a single-detached house in Toronto grew the most in the first quarter, the cost to build townhouses rose the most of all the buildings in scope for the survey in both Calgary and Edmonton.

It is interesting to note, says Statscan, that the rise in residential construction costs in Calgary and Edmonton coincided with the highest monthly increases recorded in new housing prices in over 15 years, with Calgary recording its recent high in March (+5.2%) and Edmonton reaching its recent high in February (+3.7%).

Moncton (+2.1%) and St. John’s (+3.0%) experienced the lowest quarterly price increases in residential building construction in Q1 2022. St. John’s and Montreal both observed a deceleration in price growth compared with the previous quarter.

* The 11 Census Metropolitan Areas (CMAs) are: St. John’s, Halifax, Moncton, Montreal, Ottawa, Toronto, Winnipeg, Saskatoon, Calgary, Edmonton, Vancouver.

Print this page