March 29, 2009

Submitted by ADC Canada

Healthy competition is the foundation of a progressive, innovative and dynamic industry. The Canadian wireless services sector stands out as a fine example of what low levels of competition can do to an industry. A real competitive environment in the Canadian wireless industry has often been promised but rarely achieved—something like the fake palm trees seen in some Toronto neighbourhoods in the middle of a winter storm.

The

latest wireless spectrum auction in the AWS bands by Industry Canada

may be easily dismissed with a roll of the eyes and the cry of “More of

the same!”. However, things are fundamentally different this time

around. A new approach in the latest auction may have done the trick.

40 MHz (out of 105 MHz) were specifically set aside for new entrants.

This has attracted the much-needed competitive attention both from

incumbents and, more importantly, from potential new

competitors—including those based overseas. Bid prices have run two to

six times higher than the U.S. auction garnered.

It may

be argued that Canada simply doesn’t have room for more service

providers, but the reality is different. There has been a lack of

healthy competition in the Canadian wireless services business scene

over the recent past. This manifests itself mainly in the form of poor

market penetration rates in Canada, which are among the lowest in the

G8 nations (compare 58% versus 77% in the U.S. [The Economist’s Pocket

World in Figures, 2007 Ed.]).

This

represents an untapped market potential that is now poised to blossom

with the stimulus of lower prices and better services from the upcoming

changes in the competitive health of the industry. Hi-tech mobile

services have almost become a necessary tool of business in the

corporate environment of developed nations. Canada cannot afford to lag

behind its G8 peers any longer, and the latest infusion of fresh

competition from the AWS auction is overdue and welcome. More

importantly, the Canadian enterprise needs to stop operating in a

sub-prime wireless environment and compromise its competitive edge on

the global economic stage.

The in-building coverage problem

While it

is great to know that things are getting better from a competitive

perspective, there is another important and often forgotten aspect of

this picture that needs even more attention in Canada now. This issue

threatens to keep a significant number of end user businesses from

reaping the benefits of increased competition and newer services in the

wireless services sector. Enterprises that occupy office building

spaces continue to face the so called “in-building coverage problem”.

This

problem is not really new and relates to the degradation of providers’

radio signals inside building spaces, limiting the availability of

wireless service. This problem has seen further aggravation due to

increased use of high-speed wireless data products, like the

Blackberry, but it’s going to get even worse with newer, high-tech

mobile services that are quickly evolving. However, with the right

knowledge, the in-building wireless problem can not only be solved, but

turned into an advantage.

{mospagebreak}

Who owns the problem

You might expect this problem rests on the shoulders of the service provider, and this is true—and false—at the same time.

A

service provider is the licence holder for its slice of the precious

and costly wireless spectrum in the corresponding geographies. Barring

a few small regional service providers, all the major providers in

Canada are business enterprises and are heavily driven by shareholder

value, business case and ROI models. Provincial and federal subsidies

do help in better distribution of service availability in less

lucrative and typically rural/remote regions, but the providers are,

for the most part, just following the money in a free-market

environment.

When it

comes to investing in in-building extensions to their macro networks,

the providers’ funding model naturally dictates a selective approach

based on ARPU (average revenue per user) calculations. Therefore, while

many of the high-density and typically public spaces meet the ROI

thresholds, there are a significant and growing number of in-building

spaces occupied by enterprise entities of all sizes that remain beyond

the ROI justification criteria. As more wireless data and other

high-tech services are added, radio propagation and penetration inside

building spaces suffer more.

A

wireless macro network build-out by the provider is driven by business

judgment and guided by RF planning techniques designed to cover the

maximum and heaviest users within a geographic space and with due

regard to the dynamics of traffic patterns and demographic changes. The

nature of a large majority of in-building coverage problems is

typically not the lack of capacity in the macro network but the lack of

the facility to distribute that capacity inside in-building venues.

Even so, each provider may have a different level of macro capacity and

signal strength in any area due to differences in tower locations,

technology and relative architectural differences.

Service

providers are not oblivious to this problem, and there have been

innovations in developing smaller base stations. These ‘femto cells’

are basically IP-fed miniaturized versions of macro cell sites, and

they have their place in the overall solution set. Being small allows

them to be mounted inside buildings and, since they are IP fed,

structured cabling can be leveraged for connectivity to the radio

backhaul gear.

This,

however, doesn’t solve the problem for the typical medium- to

large-enterprise space, as a femto cell typically works best for venues

up to 3000 sf, and is not really a ‘distribution’ solution, which is

really what is required for uniform coverage inside buildings. It is

more of a capacity drop and, therefore, is unable to provide uniform

coverage for medium- to large-size venues.

Installing

several femto cells to cover larger spaces only results in high cost

beyond the ROI threshold, as it leads to waste of precious spectrum to

manage overlaps, frequency planning, noise and hand-offs. Even when the

provider deploys a femto cell in an enterprise, an in-building

distribution system working off one or more femto cells remains the

best way to address in-building needs of a vast majority of enterprise

spaces.

{mospagebreak}

The IB matrix

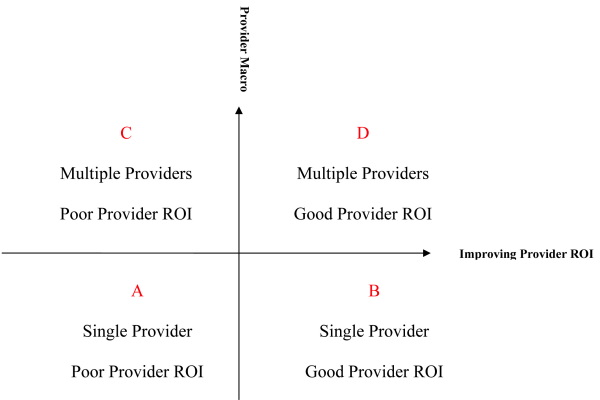

Enterprise

spaces largely fall into one of the following categories as illustrated

by the IB (in-building) matrix shown in Figure 1. This is, admittedly,

a simplified illustration, but it clarifies the choices available to

the ‘wirelessly stranded’ enterprise-in-a-building.

The

The

X-axis plots improving provider ROI, which means that building spaces

falling higher on this axis meet the ROI model of the provider and,

therefore, stand a good chance of funding by the provider. The Y-axis

plots the level of competition between providers in macro coverage. An

enterprise that is higher on this axis can expect to have increased

choices in service provider availability and, therefore, a favourable

situation.

Let us describe four broad areas (quadrants) of this matrix:

A: Only a single provider’s macro signal available in the area and enterprise falling short of provider’s ROI threshold.

B: Only a single provider’s macro signal available in the area and enterprise within the provider’s ROI threshold.

C: More than one providers’ macro signal available in the area and enterprise falling short of all providers’ ROI thresholds.

D: More than one providers’ macro signal available in the area and enterprise within the providers’ ROI threshold.

“Falling

short of providers’ ROI threshold” above also includes situations where

only fractional funding is offered by the provider to build a dedicated

IB coverage system. For the sake of simplicity, we have not included

some rare cases like availability of more than one provider but only

one or some providers willing to invest in an IB system for the

enterprise (this doesn’t affect the overall conclusions and

recommendations for the enterprise, anyway).

Situations

A and B reflect the lack of competitive choices for the enterprise and

are rather rare in urban and semi-urban regions where most of the

wirelessly stranded enterprise building are usually located. Usually,

however, more than one provider is present in urban/semi-urban areas.

Further, increased competition is expected to make this problem even

smaller in those regions, but businesses will continue to locate in

rural settings (like farms, forestry-based businesses, etc.) and that

is what Situations A and B aim to describe.

Quadrant

A is easy to analyze as it dictates investment in an IB system and

there are no other options—at least in the short term. The investment

is, however, better protected when the system is ‘neutral host’—meaning

it can accommodate more than one provider in the future and also

benefit from multiple bands from the same provider. Even when an

enterprise falls into the better of the two situations, namely B (good

ROI model), investment in a neutral host system avoids the lack of

negotiation options when new competitive providers become active in the

area.

Situations

C and D reflect acceptable competition between providers. Naturally,

situation D is ideal and businesses lucky to fall in this category

don’t really have the in-building problem, as providers have already

built IB add-ons to their macro network based on pre-existing and

recognized business justification.

It can

be deduced, then, that situations B and D don’t require the enterprise

occupant of a building to really invest in any system of its own. This

is definitely true for D but not so clear-cut for B. Depending on the

specifics of each situation, it may be better for a Situation B

enterprise to invest in a wide-band in-building system (neutral host)

of its own, which can support both the current provider as well future

competitors. It will, of course, require an investment to deploy IB

gear in the short term, but the enterprise will be in better control of

its future and possibly evolving wireless connectivity needs when new

wireless providers come knocking with new macro signals in the area.

Were the

enterprise to let the sole current provider deploy its narrow-band IB

system in their building space, the potential benefits of increased

competition will bypass them as the new entrant in future will not be

able to offer a competitive offering on the same system. In a majority

of cases, the service providers will shy away from investing their

money into an enterprise IB system when the enterprise insists on a

neutral host option versus a single carrier system that only supports

their service.

Another

related aspect to remember here is that a provider will often offer to

stretch its ROI model to accommodate an enterprise customer in exchange

for not insisting on a wide-band or neutral host system to keep

competitors out of the picture. The real value of this offer can best

be evaluated for each individual case but, more often than not, it

represents only short-term gain for the enterprise. It does free the

enterprise from not having to pay for the IB system upfront, but it

sacrifices the enterprise’s long-term negotiating power for better

service deals and control over its IB wireless future.

{mospagebreak}

Solutions

So,

unless you are an enterprise occupant of a building in situation D, you

most likely need to invest in some form of in-building distribution

system—now or soon—to stay connected at the speed of today’s business

world.

Remember,

the service provider is the owner of the spectrum licence, and an

enterprise is required by law to get the provider’s permission to

operate its own IB system. This permission takes the form of a mutual

agreement and this process is usually quite simple and quick,

especially when the enterprise is paying for the deployment of the

in-building gear. Needless to say, the system must be properly designed

and balanced to satisfy the provider that it will not cause

de-sensitization of the providers’ macro network.

Narrow-band versus neutral host

So what

choices are available to the typical Canadian enterprise with wireless

problems in its building? The broad choices are between a narrow-band

system that typically supports a single provider or a wide-band system

that supports multiple providers in the area. The latter is known as

‘neutral host’ systems. As the name suggests, these systems are key to

fully extending the benefits of a competitive wireless services

environment all the way to where it is really required—inside the

enterprise building space. However, there may be some applications

where a narrow-band system is all that is required and better suited

from a technical standpoint.

As may

be expected, the neutral host solution costs the enterprise more than a

narrow-band system. However, with the right technology (see Choices

below), this gap is much smaller; it’s very easy to deploy a neutral

host solution now and reap both the short- and long-term benefits of a

competitive wireless services environment.

Blueprint for success

In-building

systems have evolved from the earlier generation of cumbersome, passive

1/2-in. coax DAS (distributed antenna system) to more modern, active

DAS solutions that are much more in tune with the neutral host concept.

Here’s a quick, practical outline to help plan the best in-building DAS:

•

Clearly understand the nature of your wireless coverage problem by

discovering your current and potential future coordinates in the IB

matrix.

• If your matrix coordinates fall in any quadrant except D, you have some planning and work to do.

• If you

are in quadrant B, you may rely on the provider to fix the problem, but

if you anticipate the appearance of a new provider soon, investing in

your own neutral host system might be a better, longer-term option.

• If you

are in either A or C quadrant, you clearly need to invest in a good

neutral host system. If you are an A quadrant dweller, you may get away

with a narrow-band system. But with only a marginally higher

investment, you can take better charge of your future wireless destiny

by investing in a neutral host system.

• Choose the right technology/services partner and identify the provider or providers for the donor signal.

•

Negotiate and sign the necessary agreements with the provider/s with

the help and guidance of a carefully selected technology/service

partner.

• Execute the plan and deploy the system (see Choices below).

{mospagebreak}

The building blocks

Let’s

elaborate on technology and choices for the in-building system,

starting with a look at the components and the dynamics of cost

distribution thereof.

RF front end

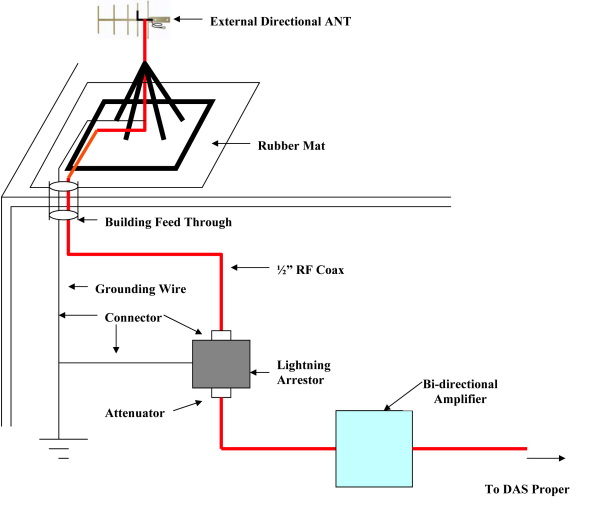

This is

This is

the portion of the system that is common to almost all types of system

options and consists of the external/outdoor antenna and other passive

and active radio electronics that capture the radio signals and prepare

them for the next portion and stage of the network, the DAS. This

represents a cost component that only changes a little in response to

the size of the DAS portion. A large portion of the RF front end cost

is for the installation and labour services (Figure 2).

DAS

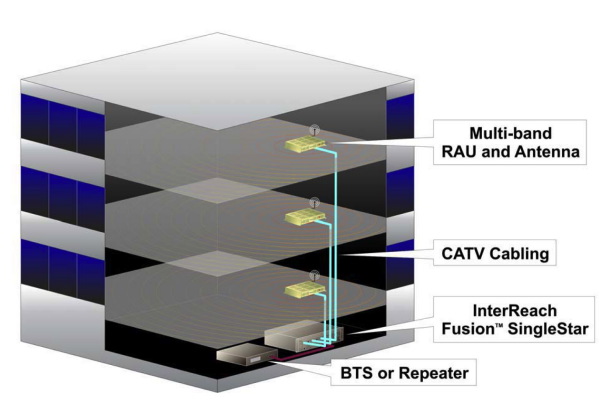

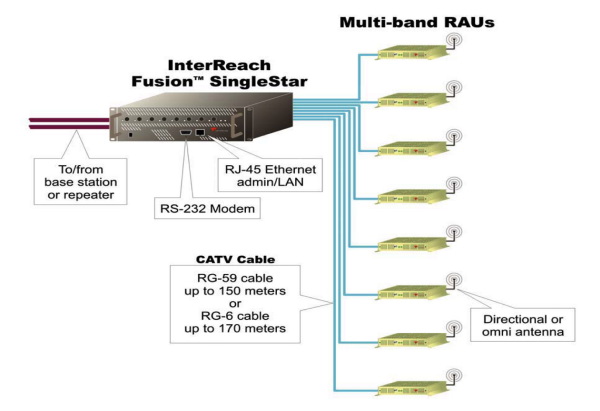

This

This

segment is the DAS proper, and is where the cost has a more direct

relationship with the size of the coverage problem in terms of area and

signal strength. This is the portion of the system that needs to be

carefully chosen for performance, initial equipment cost and cost of

installation, maintenance and future expansion (Figures 3/4).

Choices

The RF

front end is more or less standard radio gear that is pretty much falls

in the commodity bucket and there is very little to gain by choosing

one brand name over the other. The DAS itself is the real heart and

soul of the system and determines the quality of the match between what

is needed and what is delivered.

The

older generation passive systems based on rigid 1/2-in. coax are still

around but out of touch with the needs of today. These systems are from

the era of voice-only networks and simpler limited spectrum

allocations. The performance varies from band to band; they don’t scale

well and are very unfriendly when you’re looking for ease and low cost

of installation. In most of the G8 nations, these passive technologies

are being replaced by active DAS. The rate of growth of active DAS

systems in the U.S. from 2006-2010 is estimated at 300% that of passive

DAS systems.

In

Canada, many enterprises have relied on their wireline contractors or

even electrical contractors, who are not in touch with the changing

times. This has contributed to deployments that are not doing the job

and are costly to replace. The problem is even prevalent among the

providers who invest their main effort into building capacity and

coverage in the macro network rather than focus on limitations of

individual IB customers.

Depending

on the area to be covered, a simple multi-band BDA (bi-directional)

design may be sufficient but for most enterprise spaces in the size

exceeding 75,000 sf, though a well-engineered active DAS is ideal.

The

ability to switch and add providers to your system is the essence of a

long-term and sound in-building strategy, and is achieved by investing

in a neutral host IB system. That system will help solve wireless

coverage problem, and empowers you to make changes in your choice of

provider. It’s easy to relocate and upgrade , and doesn’t require a

training budget.

Conclusion

The time

is ripe for today’s enterprise to take charge of its own internal

wireless destiny and reap the rewards of increased competition and

choices in the wireless services arena. Many enterprises have already

found that, far from simply being another ‘must-do’ and/or ‘no-choice’

task, the in-building neutral host DAS actually works out to be a great

advantage in the long term.

For more information, or to get specific recommendations for your in-building coverage issues, contact ADC CANADA directly at or one of its Canadian partners: CROSSOVER DISTRIBUTION, GAP WIRELESS or DYNAMIC WIRELESS.

Print this page