Articles

Business

Features

News

Articles

70% of Canadian construction firms expect increase in number/value of projects

July 19, 2023 | By Anthony Capkun

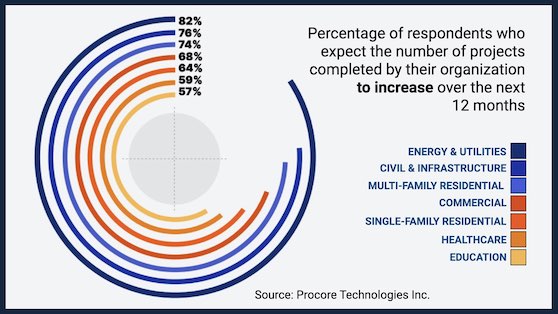

July 19, 2023 – A new report reveals 9 out of 10 of construction firms in Canada express confidence (44% Very Confident) about industry conditions over the next 12 months, with 7 out of 10 expecting an increase in the number or value of projects over the same timeframe.

The information comes from Procore Technologies’ recently released construction industry benchmark report “How we build now: technology and industry trends shaping Canadian construction in 2023”. The report examines the general sentiment of the industry, the digital maturity and adoption of construction technologies, as well as the challenges and opportunities that businesses face.

Let’s delve into some of the report’s highlights…

Residential expectations

The report shows that 43% of those who work in the residential sector expect to build more housing units in 2023 compared to 2022.

Over half of respondents from British Columbia (51%) and Alberta (55%) who work in the residential sector, however, expect to build and deliver fewer housing units in 2023 compared to 2022.

This is a stark contrast to Ontario, where 60% of respondents expect to build and deliver more housing units this year.

Labour shortages and supply chain problems

Respondents consider the hiring and retention of skilled labour as one of the top challenges they face over the next 12 months.

• 29% report they have been unable to take on more projects in the past three to six months due to a labour shortage.

• 27% agree it is hard for construction to compete with other industries for good employees.

• 27% agree there is too much competition in construction for talent.

• 32% of respondents fear that some of their most experienced people will retire within the next few years, taking valuable knowledge with them.

Despite these labour challenges, respondents are optimistic; roughly 8 in 10 are confident they will have enough people to meet their organizational needs (79%), and the necessary skills to meet demand (80%) over the next 12 months.

Supply chain problems are impacting respondents to varying degrees across the country. Quebec-based respondents report the highest impact, with 41% reporting significant delays due to supply chain issues, compared to 35% of respondents from Ontario and just a 1/4 of respondents from BC.

Digital transformation is critical

Construction firms in Canada understand that digital transformation is required to overcome the labour shortage: 22% of construction businesses consider themselves a digital-first business, while and 51% believe they are well on their way to adopting digital formats and workflows.

Decision-makers recognize that technology provides benefits, particularly around resource efficiency through less rework. The survey shows 27% of the total time spent on a project is spent on rework or rectifying issues. Respondents also indicated:

• Almost half of all projects go over budget (50%) and over schedule (49%).

• Over 30% need new technology to improve operational efficiency and cost controls amid economic volatility.

• Paper remains a common medium for Canadian construction decision-makers. About a 1/4 of respondents (23% to 28%, depending on the workflow) still use paper-based records or non-digital processes as part of their workflows.

Data as a competitive difference

Industry realizes the value of data, yet they feel they are unable to leverage data to its fullest. 41% of respondents feel they would be able to make better decisions had they better access to both real-time and historic information on project performance.

• Respondents believe they could save up to 12% of their total spending on projects if they could capture, integrate and standardize data more efficiently.

• Respondents report spending 17% of their time on a typical project searching for data or information.

• Half of the respondents say they have a foundation in place to begin learning from their data, but don’t necessarily have a dedicated data team in place. 1 in 5 say much of their data exists in spreadsheets or on paper, and they do not leverage data to drive business outcomes.

Respondents rate construction management platforms, clean technologies involving green, sustainable or innovative materials, and next generation BIM as the top technologies that will drive change in the construction industry over the next three years.

• Over half (56%) are either currently using (29%) or plan to adopt a construction management platform (27%) over the next 12 months.

• Roughly than 6 out of 10 (62%) of Canadian organizations are either currently using (26%) or plan to adopt (36%) clean technologies over the next 12 months.

Sustainable construction

Industry appears keen to adopt environmentally conscious and sustainable building practices. Half of the respondents have started to focus on strategies like prefab and improved material selection to reduce the carbon footprint of their projects. 4 in 10 are either currently tracking or plan to start tracking carbon emissions on their projects.

For more insights, visit Procore to download “How we build now: technology and industry trends shaping Canadian construction in 2023”.

The survey from which the report was produced was conducted by Censuswide, and involved about 500 respondents.

You’ll find all Back Issues of Electrical Business Magazine in our Digital Archive.

Print this page