Business

News

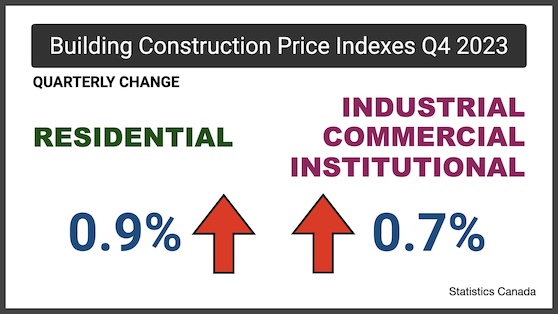

Building construction prices decelerate in Q4 2023, but still see increase

February 12, 2024 | By Anthony Capkun

February 12, 2024 – Residential building construction costs increased 0.9% in the fourth quarter of 2023, reports Statistics Canada, following a 1.2% increase in the previous quarter. Non-residential building construction costs rose 0.7% in Q4 2023, following a 1.3% increase in the previous quarter.

The deceleration observed in Q4 continued the 2023 trend of abating price pressure in both residential and non-residential building construction costs.

Q4 also marked the slowest quarterly growth since the second quarter of 2020 for residential building construction costs, and the slowest quarterly growth since the fourth quarter of 2020 for non-residential building construction costs.

Year-over-year, construction costs for residential buildings in the 11-census metropolitan area (CMA) composite rose 6.0% in the fourth quarter of 2023, while non-residential building construction costs increased 5.4%.

(The 11-census metropolitan area composite comprises St. John’s, Halifax, Moncton, Montreal, Ottawa, Toronto, Winnipeg, Saskatoon, Calgary, Edmonton, Vancouver.)

In Q4 2023, residential building construction costs rose across 10 of the 11 CMAs measured. Calgary and Vancouver saw the largest quarterly increases (each up 1.7%). Edmonton (-0.1%) was the only CMA to record a decline in residential construction costs.

In the 11-CMA composite, the cost to build townhomes and low-rise apartment buildings (each up 1.0%) experienced the strongest increases of all residential buildings in scope for the survey.

Costs to construct non-residential buildings increased the most in Winnipeg and Saskatoon (each up 1.0%) in the fourth quarter.

Of all non-residential buildings surveyed, the cost to build shopping centres, warehouses, and schools all experienced the same cost pressure (+0.7% for each) in the fourth quarter.

Building construction prices – 2023 in review

As construction activity remained strong through 2023, persistent labour shortages across several industries increased competition for labour, driving wages and, ultimately, construction prices higher.

With interest rates remaining elevated through the year, new housing starts slowed (-8.2%) in 2023, as did number of building permits and permit values for both new residential and non-residential construction.

With activity slowing, the construction industry job vacancy rate ended November 2023 at 4.5%, its lowest level since February 2021. Despite the steadily declining vacancy rate, persistent skilled labour shortages put upward pressure on wages in most industries through 2023.

As these pressures continued to abate, residential and non-residential construction costs continued to decelerate through 2023 from the double-digit increases seen in 2022.

In 2023, the 11-CMA composite for residential building construction costs rose 7.6% on an annual average basis, a deceleration from the double-digit increases observed the year prior. Cost increases varied significantly across CMAs, with Toronto (+12.7%), Halifax (+8.2%), and Vancouver (+7.8%) experiencing the largest cost increases in 2023.

The 11-CMA composite for non-residential construction costs increased 7.1% on an annual average basis in 2023 following a record yearly increase (+12.5%) in 2022. Costs increased across all CMAs measured in 2023, with Moncton (+12.1%) experiencing the largest increase, followed by Ottawa and Vancouver (each up +8.4%).

Print this page